Minimum wage salary calculator

Due to the nature of hourly wages the amount paid is variable. The second algorithm of this hourly wage calculator uses the following equations.

4 Ways To Calculate Annual Salary Wikihow

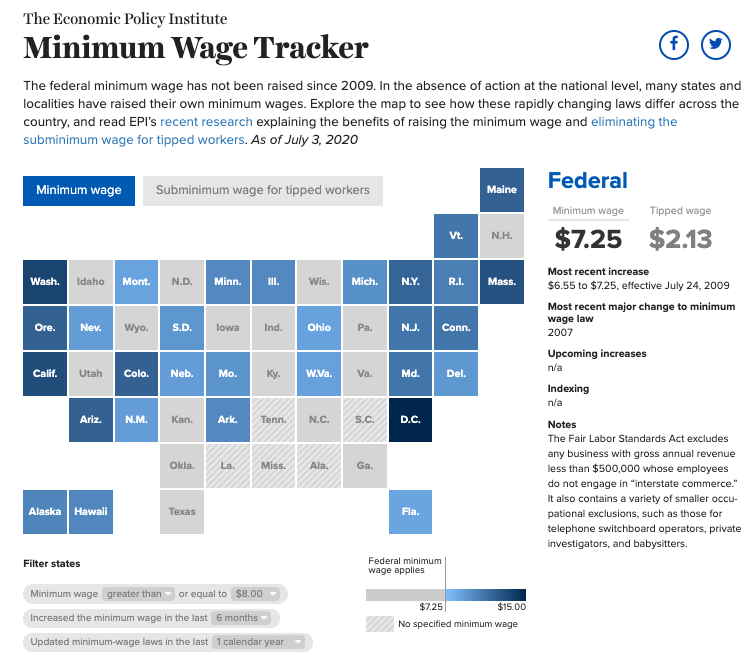

This is set by the government and currently stands at 725 per hour but many states have their own minimum wage.

. What Size Is The Employer. That goes for both earned income wages salary commissions and unearned income. 1500 per hour x 40 600 x 52 31200 a year.

To protect workers many. Related Take Home Pay Calculator Income Tax Calculator. This page includes resources related to minimum wages in each state.

No worker can be paid less. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Federal. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in California.

This is 38 of the minimum wage. The minimum wage in Finland is 7 - 8 per hour. The National Minimum Wage applies to employees not covered by an award or registered agreement.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The Salary Calculator converts salary amounts into their equivalent values based upon payment frequency. Check if your pay matches the National Minimum Wage the National Living Wage or if your employer owes you payments from the previous year.

Does the employer pay toward medical benefits. Living Wage Calculation for Massachusetts. Most working people in Britain have a right to a minimum level of pay through the National Minimum Wage.

National Minimum Wage and Living. The tool helps individuals communities and employers determine. This calculator can determine overtime wages as well as calculate the total earnings.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Massachusetts is a flat tax state that charges a tax rate of 500. You can use our Paycheck Calculator to discover whats your annual weekly or monthly salary if youre.

Employer payments must be toward a qualifying. See where that hard-earned money goes - Federal Income Tax Social Security and. For the cashier in our example at the hourly wage.

The rules can be pretty complicated however so weve. Workers are entitled to a minimum of 987 per hour. The rate set centrally is known as the federal minimum wage and has.

The National Minimum Wage. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C Weekly salary HW. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

A salary or wage is the payment from an employer to a worker for the time and works contributed. This is the minimum pay rate provided by the Fair Work Act. This calculator can determine overtime wages as well as calculate the total.

Tipped workers receive at least 375 per hour as their minimum wage. Overview of Massachusetts Taxes.

Prorated Salary Easy Guide Calculator Hourly Inc

Salary Inflation Calculator To Calculate Raise Needed To Keep Up

Alabama Wage Calculator Minimum Wage Org

Ctc Salary Breakup Calculation Excel Sheet Automatic Calculation Cost To Company Youtube

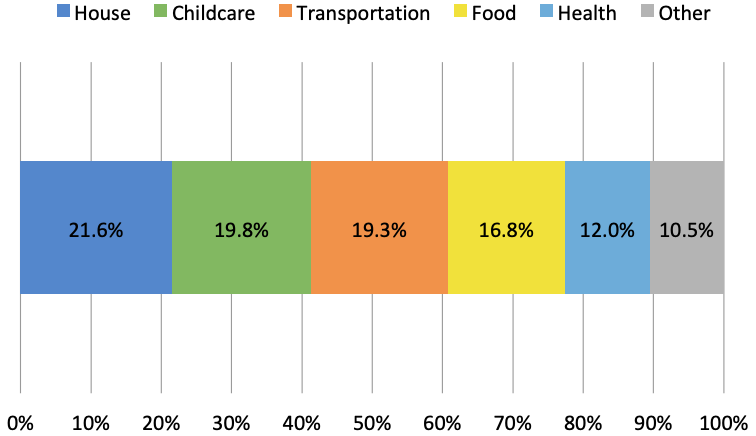

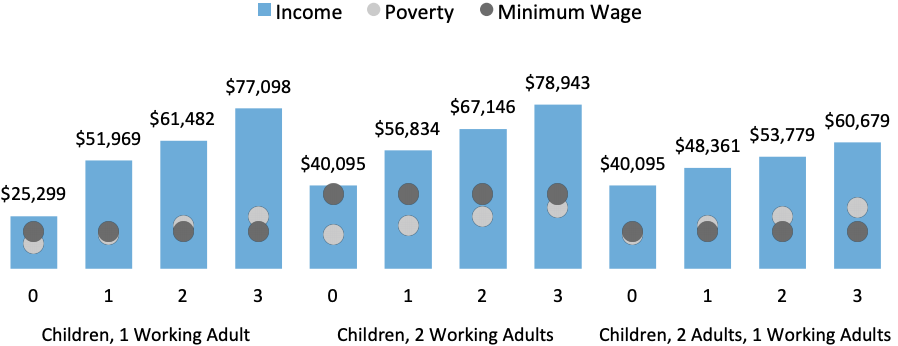

Living Wage Calculator

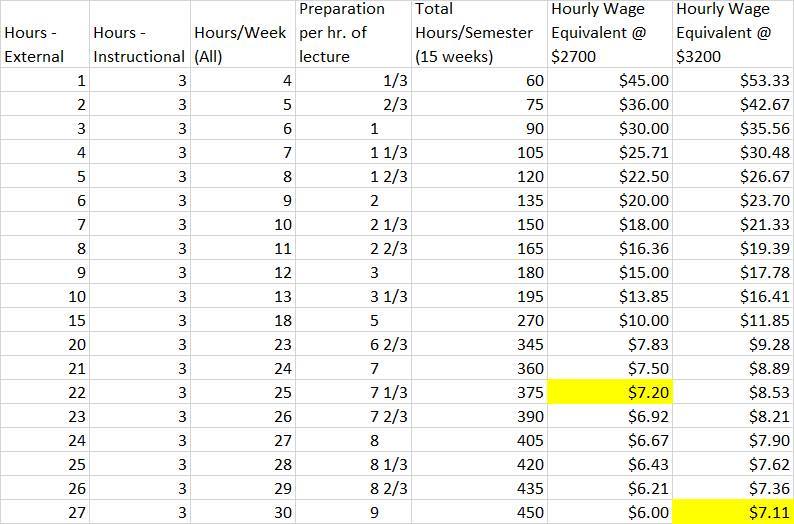

An Adjunct S Guide To Calculating Your Hourly Wage Equivalent Phillip W Magness

Salary Formula Calculate Salary Calculator Excel Template

Pay Raise Calculator

Living Wage Calculator

Hourly To Salary Wage Calculator Salary Calculator

Hourly To Salary What Is My Annual Income

Salary To Hourly Calculator How To Fire

Pay Raise Calculator

Minimum Wage Tracker Economic Policy Institute

How To Calculate Wages 14 Steps With Pictures Wikihow

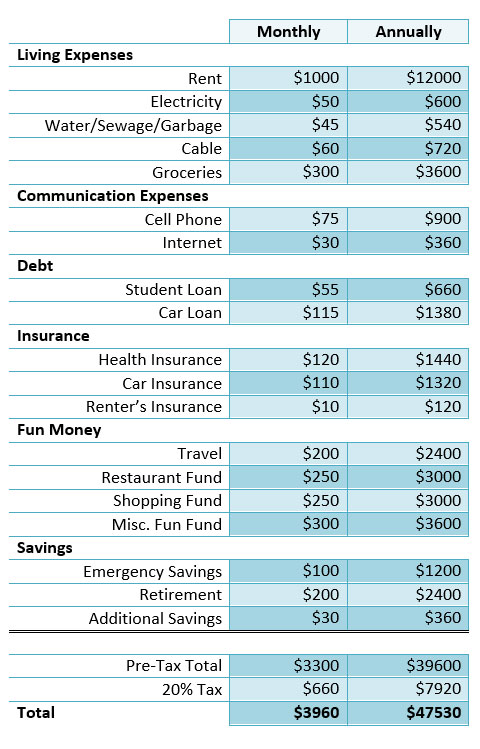

How To Calculate How Much You Need To Earn

Chart The Living Wage Gap Statista